How to Calculate the Patent Box Benefit

We outline here the accounting steps which are necessary to calculate the Patent Box benefit.

We also present a simplified example calculation which may help you to estimate the amount of saving in UK Corporation Tax you might expect to make if you were to elect in to the Patent Box regime.

You will need to seek the advice of your corporate tax advisor for an accurate estimate of savings you might achieve and the best accounting approach to make the biggest saving.

Calculating the Reduction In Corporation Tax

The tax calculation required by the Patent Box legislation is complicated and specialist tax advice is required. We set out below the basic approach to assist with a preliminary assessment of the likely benefit to a company from the Patent Box.

In the calculation, it is not necessary to estimate the proportion of profit attributable to each qualifying IP right. Instead, the legislation requires the calculation of a routine return and a marketing deduction to be made. The routine return is defined in the legislation as 10% of the deductions on the balance sheet (excluding R&D expenses and capital expenditure). The routine return is subtracted from a profit attributed to the relevant IP income to give a qualifying relevant profit. The qualifying relevant profit is then reduced by the marketing deduction to take account of marketing costs in order to arrive at the relevant IP profits. The relevant IP profits are essentially the profits HMRC attributes to the existence of the qualifying IP right. Under the nexus rules, relevant IP profits have a relevant R&D fraction applied that reflects the proportion of relevant R&D expenditure by the company. In effect the Patent Box allows companies to pay a lower rate of UK Corporation Tax on the calculated relevant IP profits for which they contributed in R&D expenditure.

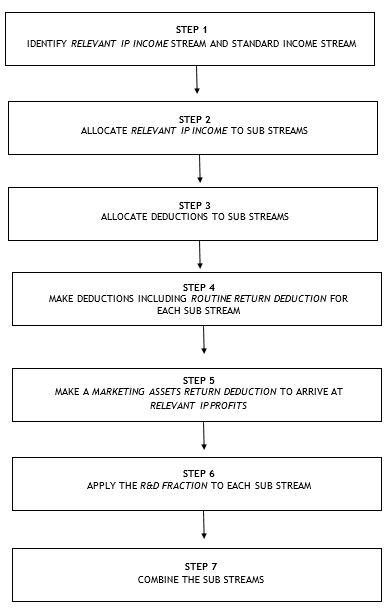

The chart below sets out the seven steps of the calculation to arrive at the proportion of relevant IP profits attributable to IP from which the UK Corporation Tax deduction available under the Patent Box can be calculated.

Steps 1 to 7

In the calculation, Step 1 requires relevant IP income and standard income to be determined and divided into a relevant IP income stream and a standard income stream. The total of these should be the total company income. This involves considering all income streams and apportioning them either as relevant IP income or as non-relevant IP (standard) income.

In Step 2, the relevant IP income stream is allocated to sub streams. It is required that IP right level streaming is chosen where income is apportioned against each Relevant IP Right, if possible. However, product or process level streaming or product family streaming are possible. These sub streams allow appropriate deductions and an R&D fraction to be applied in cases where there are multiple IP rights and/or multiple products or processes contributing to the IP income. The sub stream level will depend on how the IP rights correlate to the products or processes. A global stream may be used for small claims.

In Step 3, debits to be deducted in arriving at taxable trading profit are allocated to each relevant IP income sub stream. These include R&D expenditure or R&D tax credits.

In Step 4, after making the deductions from Step 3, a routine return is calculated and then further deducted to arrive at a qualifying relevant profit (QRP). In legislation, the routine return is set at 10% of routine expenditure. Routine expenditure does not include R&D expenditure.

In Step 5 appropriate marketing assets are determined as a marketing assets return and deducted. This step takes into account income that is derived from goodwill or branding, which is not eligible for Patent Box, as opposed to income from IP activities.

In Step 6 an R&D fraction is calculated and applied to each sub steam to arrive at a relevant profits (RP). In the calculation, the sum of direct R&D expenditure (D) and third party subcontracted R&D expenditure (S1), with a 30% “good R&D” uplift, is divided by the total expenditure, which consists of the “good R&D” expenditure (D + S1), plus connected party subcontracted R&D expenditure (S2) and IP acquisition cost (A). The R&D fraction is (D+ S1) x 1.3/ (D + S1 + A + S2). However, the fraction is capped at 1.

In Step 7 the relevant profits with R&D fraction applied, for each stream, are added together to determine the total relevant profit attributable to the Patent Box.

Calculating the Patent Box Deduction

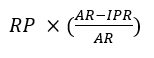

The effect of the Patent Box legislation is to reduce the profit on which UK Corporation Tax is payable. The calculated total relevant profits (RP) from Step 7 are multiplied by either the main rate of Corporation Tax, or the small profits rate if applicable (AR) minus the special IP rate of Corporation Tax (IPR, 10%) divided by the main rate of Corporation Tax. i.e.:

This leads to a Patent Box deduction which is subtracted from the taxable profits before the amount of UK Corporation Tax is calculated at the relevant main rate.

Example Calculation

Company A has trading turnover of GBP 1,000k, of which GBP 700k is from the sale of items covered by a two qualifying IP rights – GBP 500k for IPR1 and GBP 200k for IPR2. For IPR2, 20% of the profit is attributed to branding, as opposed to exploitation of IPR2.

Company A has tax deductible expenses of GBP 750k including GBP 50k for R&D. Total deductions for items relating to IPR1 and IPR2 are GBP 100k each. All the R&D for IPR1 was conducted in-house in a previous year. IPR2 was acquired for GBP 40k in a previous year with a further GBP 50k spent on R&D this year.

Without the Patent Box, the Corporation Tax computation would be as follows:

Trading income GBP 1,000k

Tax deductible trading expenses: GBP 500k

Taxable trading profit GBP 500k

Corporation Tax payable (assuming 25%) without the Patent Box is (GBP 500k x 25%) = GBP 125k

The Patent Box calculation is as follows:

Step 1 – Establish a standard income stream and a relevant IP income stream:

Standard income stream = GBP 300k

Relevant IP income stream = GBP 700k

Step 2 – Income for the two sub streams relating to the two IP rights, IRP1 and IPR2, is allocated:

Relevant IP income for IPR1 sub stream = GBP 500k

Relevant IP income for IPR2 sub stream = GBP 200k

Step 3 – Allocate debits to be deducted in arriving at taxable trading profit:

Deductions for IPR1 sub stream = GBP 100k non-R&D costs

Deductions for IPR2 sub stream = GBP 50k R&D costs, GBP

50k non-R&D costs

Step 4 – Net profit is reduced by the routine return to arrive at qualifying relevant profit (QRP). None of the deductions allocated in Step 3 to the IPR1 sub stream relate to R&D, so all are included in the routine return calculation:

IPR1 sub stream QRP = (500k – 100k) – (100k x 10%) = GBP 390k

Only GBP 50k of the deductions allocated in Step 3 to the IPR2 sub stream relate to non-R&D costs, so only these are included in the routine return calculation:

IPR2 sub stream QRP = (200k – 100k) – (50k x 10%) = GBP 95k

Step 5 – Deduct marketing assets return. All the profit for the IPR1 sub stream arises from exploitation of the IP, whereas 20% of profit for the IPR2 sub stream is attributable to branding:

IPR1 sub stream QRP with marketing deduction = 390k – 0 = GBP 390k

IPR2 sub stream QRP with marketing deduction = 95k – 19k = GBP 76k

Step 6 – Calculating and applying R&D fraction to arrive at relevant profits. IPR1 was developed completely in-house, so the R&D fraction for that sub stream is 1. On the other hand, the company spent 50k on in-house R&D and GBP 40k acquiring IPR2, so the R&D fraction = (50k x 1.3)/(50k + 40k) = 0.72

IPR1 sub stream RP = 390k x 1 = GBP 390k

IPR2 sub stream RP = 76k x 0.72 = GBP 55k

Step 7 – Combine the relevant profits, with R&D fraction applied, for each stream to arrive at total relevant profits:

Total relevant profits = 390k + 55k = GBP 445k

Finally the patent box deduction can be calculated. In this case, assuming 10% Patent Box rate and Corporation Tax rate of 25%: (445k x ((25-10)/25)) = GBP 267k

So the full rate of Corporation Tax is payable on the taxable trading profit (GBP 500k) minus the patent box deduction (GBP 267k) = GBP 233k.

At a Corporation Tax rate of 25%, Corporation Tax of GBP 58k (GBP 233k x 25%) would be payable with the Patent Box, compared to GBP 125k without the Patent Box.

The Calculation – Considerations

The calculation to arrive at the patent box deduction, requires the input of figures which some companies’ existing accounting procedures may not readily provide. In particular, this is likely to be the case where companies have multiple sources of income, some of which will be relevant IP income and some of which will be non-relevant IP income. Further, companies will need historic data regarding relevant R&D expenditure. Companies may therefore need to address this information deficit before they are able to determine likely Patent Box benefit. A detailed understanding of income and costs and how they are attributable between various income streams will be required.